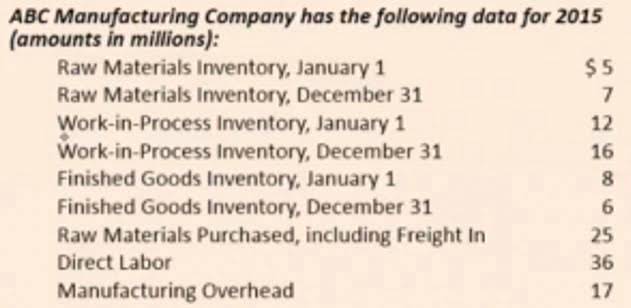

Labor efficiency ratios can help assess productivity and identify improvement areas. Optimizing labor allocation and investing in training can enhance productivity and reduce costs. Understanding labor dynamics is also critical for accurate product costing and pricing. The components of incremental manufacturing cost typically include direct materials, direct labor, Coffee Shop Accounting and variable overhead. Direct materials, such as raw inputs like steel or plastic, increase proportionally with production. Similarly, direct labor costs rise as more workers or additional hours are required for higher production demands.

In the realm of data analysis and business intelligence, seamless data connectivity stands as a… Technology push innovation introduces solutions driven by advancements in engineering and science, often before the market recognizes a need. Supporting innovation through government policies, funding for research and development, and the establishment of innovation agencies creates environments that foster technological advancements. This approach suits industries with high operational complexity, such as manufacturing or logistics. Disruptive innovation transforms industries by introducing entirely new ways of operating.

You calculate your incremental cost by multiplying the number of smartphone units by the production cost per smartphone unit. That is why it is critical to understand the incremental cost of any more units. You can then compare these to the price you earn for selling the units to see whether your business is profitable enough. Expanding a product line involves additional expenditures on production, storage and management capacity for new products with varying qualities and characteristics. The company may face disruptive transition costs in trainings, infrastructure updates or acquisitions to cover the increase in demand.

From an economic perspective, incremental cost embodies opportunity cost—the value of the next best alternative foregone. The incremental cost includes not only the flour, butter, and labor but also the potential revenue lost by not using the same resources elsewhere (e.g., making baguettes). Remember that incremental cost analysis should consider both short-term and long-term effects.

When evaluating a business segment’s profitability, only relevant incremental costs that can be directly linked to the business segment are examined. A company recently introduced automation technology to streamline its manufacturing process intending to save on labor costs. Thus they realized incremental cost that they have incurred considerable incremental costs apart from baseline cost which does not reflect favorably on overall project implementation.

Companies look to analyze the incremental costs of production to maximize production levels and profitability. Only the relevant incremental costs that can be directly tied to the business segment are considered when evaluating the profitability of a business segment. Incorporating incremental cost in business strategies offers several benefits, including improved decision-making, cost optimization, resource allocation, risk assessment, and enhanced profitability. By considering the incremental cost, businesses can make informed choices and maximize their financial outcomes.

In summary, incremental cost analysis empowers decision-makers to optimize resource allocation, evaluate projects, and make economically sound choices. By understanding these methods, you’ll be better equipped to navigate the complex landscape of decision-making. Assuming a manufacturing company, ABC Ltd. has a production unit where the cost incurred in making 100 units of a product X is ₹ 2,000. In the above formula, the total cost of increased production refers to the previous volume and the new units added to it. However, none of it will include the fixed costs since they will not change due to volume fluctuation. Examples of incremental cost include the cost of producing an additional unit of a product, the cost of expanding a business, and the cost of upgrading equipment.

Incremental costs are also referred to as marginal costs, but there are some basic differences between them. You may estimate how cash flow much you should budget for your firm and how much profit you might make by conducting this type of cost analysis ahead of time. So, you can then assess whether or not it makes business sense to expand operations.